In 2017 and 2018, the Chinese government implemented waste import restrictions limiting or banning a variety of recyclable material they had previously accepted for processing.

It was summer of 2017, when the Chinese first signaled this change in policy and notified the World Trade Organization (WTO) that they would be banning the import of 24 categories of waste, including several kinds of scrap plastic and mixed paper.(1)

The Chinese government also specified that other waste materials, such as cardboard and scrap metal, have a very strict contamination rate of only 0.5 from food and other sources. Contamination rates of U.S. recyclables vary, but can reach 25 percent or higher. (2)

The following January, when China began to implement the ban on the flow of materials, this entirely upended the U.S. recycling market. It created significant challenges throughout the supply chain of scrap for residents, solid waste departments, material recovery facilities (MRFs), processors, end users, etc. (3) This article reviews the background and impacts of these changes.

Import restrictions on mixed paper and plastics

Specifically, China restricted imports of mixed paper such as magazines, cardboard, office paper, junk mail, and most plastics. This ended a long-term practice of the Chinese buying enormous amounts of recyclable plastics, paper, cardboard and other materials from the United States, Canada, Germany, the United Kingdom and Japan to fuel their (formal and informal) manufacturing.

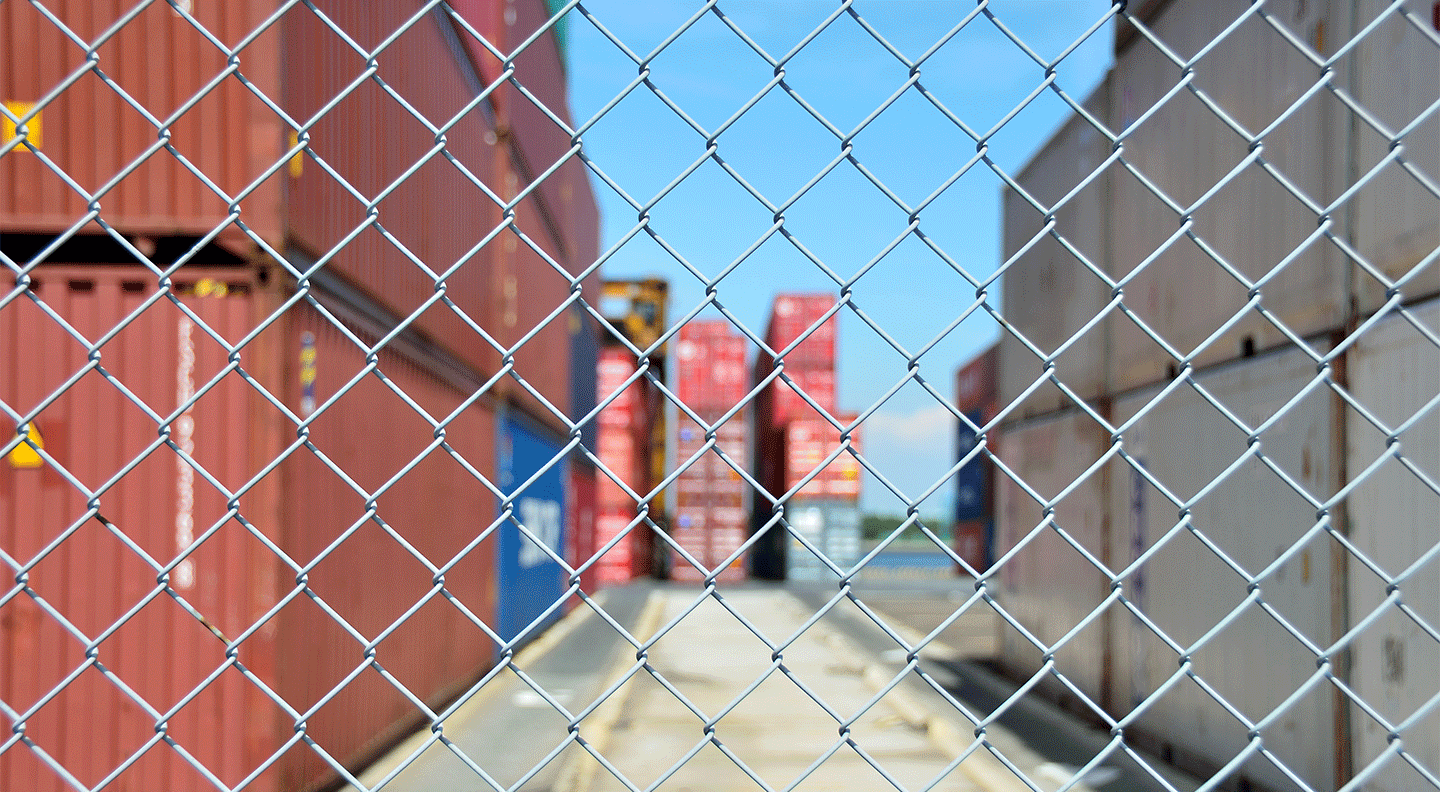

Historically, China was receiving about 40 percent of U.S. paper, plastics and other recyclables. It was cheap for recycling collectors to send scrap to China, as ocean carriers offered major discounts on the pricing for shipping containers heading back to Asia after arriving at U.S. ports with goods made in Chinese factories. This relationship was symbiotic as developed countries, such as the United States, lacked the recycling facilities and labor pool to manage their recyclables efficiently and cost effectively, while the Chinese were hungry for materials to fuel their manufacturing surge.

Impacts of the ban

This shift in Chinese trade policy was driven by domestic concerns as solid waste has emerged as their primary environmental challenge and they are under tremendous pressure to boost domestic recycling capacity. In this light, they are facing a solid waste treatment backlog of approximately 60-70 billion tons. (4)

As U.S. waste management companies contend with the resulting market realities, they continue to evaluate their pricing strategies and other changes to their operations. They have been telling municipalities that there is no longer a market for their recycling and that they have two choices:

- Either pay much higher rates to recycle collected material, or

- Throw it all away. (5)

Due to fiscal constraints, most municipalities are choosing the latter. This has resulted in the suspension or complete halt of curbside recycling, the stockpile and storage of material for potential future management, landfill or incineration.

Some of the worst hit places now have “no market” at all for materials like mixed paper (cereal boxes, junk mail, magazines) and some types of plastics. This includes parts of the Pacific Northwest, which traditionally sent a greater proportion of its recycling to China and New England, where waste processing costs were significant before the ban.

According to an in-depth study performed by Waste Dive, at least 10 states (including California, Hawaii, Massachusetts, North Carolina and Oregon) have been “heavily” impacted by China’s new policy, and 38 states (at the time of publication) have experienced “noticeable” impacts. (6) Across the country, curbside programs are being eliminated resulting in the stockpiling of baled paper and plastics in the hopes that new markets will eventually be found for them.

Unfortunately, large amounts of mixed plastics are ending up dumped in landfills due to lack of demand. For example:

- Deltona, Florida and Franklin, New Hampshire are ending curbside pickups to cut costs passed on to the public.

- Philadelphia sent half of collected recyclables straight to the incinerator in January.

- Minneapolis stopped accepting black plastics.

- Marysville and Michigan no longer accept 11 categories of items for curbside recycling including glass, newspaper and mixed paper.

It is considered ironic and tragic by many environmentalists that after decades of public-information campaigns designed to inform citizens about sorting paper, metal and plastics in bins, much of this material is not being recycled.

However, as well intentioned citizens are, the education has not been successful in terms of informing citizens to step up their efforts to decrease contamination levels in the recycling bin. The public are either “aspirational” recyclers or “confused” recyclers in terms of not being clear on what materials their local recycling program accepts.

About 25 percent of what ends up in the blue bins is contaminated, according to the national waste and recycling association. (1) For decades, we have been throwing whatever we wanted (e.g. wire hangers, pizza boxes, ketchup bottles and yogurt containers) into the bin where it was sent to china and low paid workers sorted through it and cleaned it up.

These mistakes create more work in terms of hand sorting, which the Chinese are able to absorb with lower labor rates. However, for U.S. companies that rely proportionately higher on mechanized sorting versus manual labor for sorting, such mistakes are much more costly and are passed on to the municipality. Hence, it is often a better business option for companies to manufacture using new materials, because virgin plastic and paper are still cheaper in comparison to using recycled materials.

Where do we go from here?

The need for a better business model

In this context, representatives of the business sector have asserted that unless U.S. municipalities develop a better and more durable business model, U.S. recycling programs will be threatened. This “more durable business model” essentially translates into higher prices on contracts. (7)

Even if the United States found a better way to sort recyclables, domestically it will always be harder than it would be in a place like China where a booming manufacturing sector fuels constant demand for materials.

In terms of the U.S. government, although the Environmental Protection Agency (EPA) does not have an official position on China’s recyclable restrictions, two themes emerges in their inter-agency comments on draft laws:

- A distinction must be made between materials sorted for use as raw materials, and

- “Solid waste” sorted materials should not be subject to total import bans.

The EPA also promoted the use of international specifications for contamination levels in recovered materials. These would be the levels identified by organizations such as ISRI and used by most countries.

U.S. Opportunities for increased processing capacity.

There is reason for some optimism in terms of China’s policy, however. China has indicated they will not prohibit the import of processed raw materials such as paper pulp or flaked plastics. So some of the domestically collected materials in the United States (in processed form) should still be okay to export to China.

This should create opportunities in the United States for increased processing capacity. Moreover, despite a year of market uncertainty and a substantial and dramatic drop in scrap plastic exports, recovered paper exports in the United States increased in 2018. (8) Exports to China remained as the most important overseas market for U.S. scrap paper, and additionally:

- 58 percent was made up of recovered fiber from old corrugated containers (OCC), and

- 13 percent of exports came from mixed paper.

The list of importing countries is evolving.

Despite this minimal 2018 growth in Chinese imports, the top importing countries list has changed dramatically over the past year as the result of import policy changes. Besides China’s disappearance from the list, Vietnam and Thailand, the largest Southeast Asian importing countries in early 2018, also no longer appear.

Malaysia, which grew to be the top importer of U.S. scrap plastic in 2018, is now well below other large importers such as India and Canada. (9) However as time goes on and policies evolve, these Asian ports are tightening rules for what imports they will accept.

We need a better way.

In conclusion, U.S. markets will continue to evolve in response to China’s stringent trade policies. The United States will need to develop better ways to sort recycling. Some U.S. markets for plastics and paper may emerge. Nevertheless, selling domestically will still be harder than it would be in a place like China, where a booming manufacturing sector has constant demand for materials.

In the meantime, it is still cheaper for companies to manufacture using new materials.

For more information about our compliance services, visit https://www.simsLIFECYCLE.com/global/compliance/.

Sources:

- Huffington Post, “The Dirty Truth is Your Recycling May Actually go to Landfills”, Dominique Masbergen, 7/25/18

- City Lab, “How China’s Shift is Changing U.S. Recycling” Nicole Javorsky, 4/1/19

- SWANA, “What You Need to Know About China’s Waste Import Restrictions” link

- Reuters “China Plans to Cut Waste Imports to Zero by Next Year: Official”, Muyu Xu, David Stanway, 3/27/19

- Atlantic “What Happens now that China won’t take U.S. Recycling”, Alana Semuels, 3/5/19

- Waste Dive “How Recycling is Changing in all 50 States”, Alana Semuels, 8/7/19

- Wall Street Journal, “U.S. Recycling Companies Face Upheaval from China Scrap Ban”, Erica Phillips, 8/2/18

- Resource Recycling “Paper Exports Grew in 2019, But Plastics Fell 35%”, Colin Staub, 3/19/19

- Los Angeles Times “How mountains of U.S. plastic waste ended up in Malaysia, broken down by workers for $10 a day”, Shashank Bengali, 12/29/18